Kaia Blockchain White Paper v1.2

Important Notice

Project Kaia1 Digital Tokens (hereinafter referred to as “KAIA” with the ticker symbol KAIA) are not intended to constitute a regulated product such as securities, fiat tokens or e-money, accepted virtual assets or specified investments each as defined under the Financial Services and Markets Regulations 2015 of the Abu Dhabi Global Market (the “FSMR”), or its equivalent or any other regulated products in any jurisdiction.

Please note that you may not be able to recover any monies paid for KAIA in the event that the KAIA Token Economy fails to materialize or where the vision or objects of the Foundation fails.

This Whitepaper is meant to provide more information on the KAIA Token Economy and functions of KAIA, and does not constitute a prospectus or offer document of any sort.

This Whitepaper does not constitute or form part of any opinion or any advice to sell, or any recommendation or solicitation of any offer to purchase KAIA nor shall it or any part of it or the fact of its presentation form the basis of, or be relied upon in connection with, any contract or investment decision.

No person is bound to enter into any contract or binding legal commitment in relation to the sale and purchase of KAIA and no digital tokens or other form of payment is to be accepted on the basis of this Whitepaper.

Any agreement between the Foundation and you as a recipient or purchaser, and in relation to any airdrop, sale or purchase of KAIA is to be governed by a separate document setting out the terms and conditions (the “T&Cs”) of such agreement. In the event of any inconsistencies between the T&Cs and this Whitepaper, the T&Cs shall prevail. Your eligibility to receive, purchase or sell KAIA on any digital token trading platform or exchange is subject to your compliance with their respective terms and conditions.

No regulatory authority has approved any of the information set out in this Whitepaper. No such action has been or will be taken under the laws, regulatory requirements or rules of any jurisdiction. The publication, distribution or dissemination of this Whitepaper does not imply that the applicable laws, regulatory requirements or rules have been complied with.

This Whitepaper, any part thereof and any copy thereof must not be taken or transmitted to any country where distribution or dissemination of this Whitepaper is prohibited or restricted.

No part of this Whitepaper is to be reproduced, distributed or disseminated without including this section and the section titled “IMPORTANT NOTES” at the back of this Whitepaper.

PLEASE READ THE SECTION TITLED “IMPORTANT NOTES” AT THE BACK OF THIS WHITEPAPER VERY CAREFULLY.

IF YOU ARE IN ANY DOUBT AS TO THE ACTION YOU SHOULD TAKE, YOU SHOULD CONSULT YOUR LEGAL, FINANCIAL, TAX OR OTHER PROFESSIONAL ADVISOR(S).

Introduction

Our Origin

The Finschia blockchain, based on the LINE Blockchain initiated by the global messaging company LINE in 2018, and the Klaytn blockchain, established in 2019 on the foundation of Kakao, South Korea's leading software company, have merged their blockchain and ecosystems under the shared goal of achieving mass adoption of blockchain technology to create the Kaia Blockchain.

Kaia Blockchain is a Layer 1 blockchain based on EVM (Ethereum Virtual Machine) and has been designed with scalability, convenience, and reliability as top priorities. Kaia Blockchain focuses on transformative changes that will empower not only technology and business but also individuals in the Web 3.0 era. Kaia Foundation2 and ecosystem participants aim for easier accessibility of blockchain technology and let more people participate in the Web 3.0 revolution. Kaia Blockchain will settle as a trusted stratum that connects people from different backgrounds all over the world.

To build the infrastructure for the collaborative Web 3.0 playground, Kaia Blockchain will combine powerful integrated community and infrastructure technologies to discover new opportunities and accelerate innovation.

Mission

Our goal is to build a fairer and more open future by ensuring people greater economic opportunities and the right to participate through blockchain.

Vision

The core vision of Kaia Blockchain is to integrate a broad user base, vast on-chain assets, and technology to help builders promptly implement and expand their ideas with successful results. As a platform, Kaia Blockchain provides the tools and environment required by the builders, providing them with the opportunity to introduce creative solutions to a wider public. They plan to create new value by leveraging on-chain assets and pursuing innovation that goes beyond technological limitations. The continued growth and success of the builder community is one of the core goals of Kaia Blockchain. For builders to turn their aspirations into reality, we will be helping builders turn their visions into reality, from the ideation stage through to implementation, market entry, and growth.

Value Proposition

Kaia Blockchain aims to create Asia's #1 blockchain through the integration of the two mainnets and lead the adoption of Web3, which was the common goal of the two blockchains. This vision can be achieved by helping builders create ideas, grow, and successfully build projects through a wide user base, abundant on-chain assets, and technology leadership as below. Kaia Blockchain provides a robust infrastructure for Web3 projects of all sizes, creating an ideal environment for builders looking to bring innovative ideas to life.

Wide User Base

-

Web2 User Accessibility: One of the biggest problems facing Web3 projects is attracting Web2 users. Kaia Blockchain provides easy access to existing Web2 users through a messenger-integrated wallet through collaboration with Kakao with 50 million Korean users and LINE with 200 million users in Japan, Taiwan, Indonesia, and Thailand.

-

Web3 User Accessibility: In addition to Web2 users, it helps attract Web3 users quickly and easily to the project by providing more than 1.2 million wallet active addresses and an interface connecting the users and the project.

-

Community Building Support: It helps users gather and build projects through joint marketing with Kaia Foundation and provides an environment with easy access and usage for users from various chains.

Abundant Liquidity Support

-

Real World Asset (RWA) Linkage: Real world assets such as gold, ships, and real estate already exist on Kaia Blockchain. Beyond this, real world assets such as various fiat-backed stablecoins and bonds will be on-chained, allowing developers to utilize a wider range of assets.

-

Large-Scale Ecosystem Fund (Kaia Ecosystem Fund): A large-scale ecosystem fund can be created based on KAIA and support various sectors requiring liquidity such as Defi and Gamefi.

-

Chain Native Yield: Built-in MEV (Maximal Extractable Value) extraction allows KAIA Stakers to automatically earn MEV profits on the chain. This results in an increase in the chain liquidity and simultaneously provides a method for burning tokens.

Top-Level Core Technology and Development Convenience

-

Top-Level Transaction Finality: Provides higher TPS and decentralization while maintaining the 1-second transaction finality.

-

Ethereum Compatibility: EVM-based dApps can be onboarded without any modifications with the provision of 100% Ethereum compatibility.

-

Convenient Account Model: The account model of Kaia Blockchain enables the assigning of various keys to accounts, which strengthens account security and improves user experience.

-

Permissionless and Decentralized Structure: Kaia Blockchain is converting into a permissionless validator structure while also increasing the network’s decentralization.

Token Economy

Introduction

Public blockchain platforms are maintained through a token model, which greatly influences the growth direction of the platform. Since blockchains generally do not have a central governing body, it is crucial to motivate the individuals who maintain and develop the blockchain to ensure its continued existence. However, it is unrealistic to expect participants to engage in blockchain security solely for altruistic motivations without seeking any financial gain. Therefore, an incentive system is necessary to motivate blockchain ecosystem participants to maintain and develop the network.

In blockchains, governance structures drive change. Blockchain platforms must change to keep pace with external developments as available technologies continue to expand and market needs change. Unlike general products developed and maintained by a single company or a central governing body, a public blockchain is not suitable for a single entity to make and implement unilateral decisions. For example, even if the main developers decide on a software update, the miners may not apply it. Therefore, a governance process is needed to collect the opinions of all participants in the ecosystem and make decisions based on the collected opinions in order for the blockchain network to implement timely changes. A stable governance structure must exist for the blockchain to adjust appropriately in response to external changes.

This chapter explains the token model and governance system of Kaia Blockchain. Kaia Blockchain aims to help builders quickly implement, scale, and achieve successful results based on its large user base, vast on-chain assets, and technology. This document will go over the design principles used to create the current features of Kaia Blockchain and how these features may change. The information provided in this document will be verified through relevant data, and part of this content may be subject to change after sufficient verification and review.

Design Principles

Designing the token economy and governance structure of a blockchain platform is complex. First, token economy and governance structures are tested under controlled conditions that do not fully reflect reality. Therefore, it cannot be prepared for all variables. It is also worth noting that the blockchain industry is still in its infancy stage and we have yet to see a successful system that operates over the long term. Kaia Blockchain considered these environmental factors and defined internal principles that are not influenced by external influences rather than maintaining a single specific model. The detailed token economy and governance structure may flexibly evolve in line with the market conditions and regulations. However, the design principles will remain unchanged as a core value shared by all ecosystem participants.

The core design principles of the token design of Kaia Blockchain are:

-

Rewarding Ecosystem Contributors: For a blockchain platform to be sustainable and provide great value to users, simply maintaining the network is not enough; the growth of the platform ecosystem is also very important. Therefore, Kaia Blockchain will identify the entities contributing to this growth and provide rewards and support commensurate with the contribution of each participant. This will result in not only contributors to block creation and verification but also service providers who have contributed to the growth of the platform ecosystem receiving reasonable compensation in proportion to their contribution, acting as an attractive incentive for potential external contributors.

-

Elastic Token Economy: The token economy has numerous active participants with different interests and is greatly affected by various internal and external changes. Therefore, the token economy will be flexible to external variables based on consistent core principles rather than maintaining a single model. Based on these core principles, the token economy of Kaia Blockchain can respond quickly and flexibly to external changes. At the same time, it can support the ecosystem participants to operate stably and align the direction to promote overall growth.

-

Sustainable Growth: Blockchain platforms must maintain continuous growth. In other words, it must retain the existing and new participants within the ecosystem based on a reasonable incentive model and a system that can flexibly respond to the needs and impacts of rapidly changing markets within and outside the ecosystem. In return, Kaia Blockchain will be able to achieve balanced and stable growth based solely on the contributions of ecosystem participants without any artificial value expansion.

-

Simplicity: Kaia Blockchain will be explainable simply and clearly. This will allow for quick optimizations and fixes in the future. Its simplicity will allow everyone involved to easily understand the functionality.

-

Experiment and Optimize with Data: How high should inflation be? What types of rewards should be given for what actions? These questions are difficult to answer without testing and verification. Kaia Blockchain will transparently analyze data obtained and managed on the blockchain, optimize the platform by testing various hypotheses, and transparently share the results through technical reports.

Kaia Blockchain Tokenomics

KAIA

KAIA is the platform-native cryptocurrency of the Kaia Blockchain, used to enhance the security of the Kaia Blockchain through staking or to pay transaction fees. Transaction fees are incurred when deploying or executing smart contracts, or when transferring tokens.

KAIA is an essential element and fuel for operating the Kaia Blockchain platform. The users’ KAIA is paid to the validators to execute tasks requested by clients of the platform. In other words, KAIA is an incentive that will ensure developers write high-quality application codes (wasteful codes cost more) and the network remains healthy (validators are compensated for the contributed resources).

Kaia Blockchain’s Incentive Mechanism

The incentive mechanism of Kaia Blockchain seeks to achieve the following goals:

-

Ability to maintain sufficient economic security and network over the long term.

-

Support for entities promoting economic activity

In general, incentives in public blockchains are used to maintain the network and ensure economic security. Maintaining a blockchain requires someone to continuously store block data and process new transactions. Due to this, blockchains such as Bitcoin or Ethereum provide block rewards to miners processing block creation. Incentives are also closely related to economic security. Simply put, economic security is proportional to the cost required to carry out an attack on a blockchain. This cost typically becomes higher as the potential profit of the block creator increases during the block creation process.

Incentives are necessary to ensure a high level of economic security and a well-maintained network. And for the system to operate stably, the value of cryptocurrency must be maintained or rise. If the value of cryptocurrency falls suddenly, the economic security and network stability may decline proportionally.

The stability or increase in value of KAIA largely depends on its utility. This utility comes from a large number of people using and burning KAIA, which occurs when high-quality service providers actively provide services on Kaia Blockchain.

Economically Sourced Incentives

Kaia Blockchain provides incentives through the issuance of new KAIA and transaction fees. Additionally, to maintain the value of KAIA as a means of economic support, sustainable methods for distributing and burning KAIA exist.

Minting

On the Kaia Blockchain mainnet, a certain amount of KAIA is issued whenever a new block is created. Each time a new block is created, a certain amount of KAIA will be newly issued, and the target initial annual inflation rate (amount of KAIA newly issued per year / total KAIA token in the market) of Kaia Blockchain will be set at 5.2%3. The number of newly issued KAIA per block at this point is not permanently set; it can be changed through governance voting. By default, the inflation rate of KAIA reflects the economic growth rate of Kaia Blockchain. Although the goal is a lower value, the exact value will be determined through the governance. In the mid to long term, the inflation rate and new issuance quantity per block can be automatically calculated and applied based on the inflation algorithm inherent in the chain.

Transaction Fee

Kaia Blockchain has determined its transaction fee policy to maximize service orientation, user-centricity, and enterprise-friendliness while maintaining network stability. The transaction fee policy takes into account the following points pursued by Kaia Blockchain.

-

Improved User Experience

- We aim to minimize complicated or unnecessary procedures when users pay transaction fees. This will allow users not familiar with blockchain technology to easily use Kaia Blockchain. For example, tasks such as manually entering gas prices should be minimized. The volatility of the transaction fee should also be minimized so that users can use Kaia Blockchain comfortably.

-

Improved Operational Processes for Service Providers

- Service providers can pay for the transaction fees on behalf of users through the unique account model in Kaia Blockchain. Therefore, business convenience for dApp service providers is also a major consideration in fee policy.

- The basic elements to reduce the burden on service providers are low transaction fees and low volatility fee policies. The low fee is to assist in the expansion of services using the fee delegation feature in the Kaia account model, while the low volatility is to help predict business costs due to the payment fee.

-

Protection against Network Attacks

- Blockchain data storage and computation incur costs. Without transaction fees, attackers may DDoS or spam attack the blockchain by sending meaningless transactions. To prevent meaningless transactions, a reasonable fee will be imposed on transactions.

Kaia Blockchain applies a dynamic gas fee model to the network to achieve the above goals. In the dynamic gas fee model of Kaia Blockchain, a low fee is applied in general cases where there are not many transactions on the network. However, in special situations such as a rapid increase in transactions on the network or a DDoS or spam attack, the gas fee increases. This results in a reduction of meaningless transactions. The dynamic gas fee model could change the gas fee per block unit dynamically depending on the transaction congestion within the network, but the range of change is predictable to some extent. Transactions entered into a block have transaction fees calculated with an identical block gas fee (baseFee), and only transactions with a gas fee greater than or equal to the block gas fee can be entered into the block. Block gas fees automatically increase or decrease depending on the gas usage of the previous block with the current maximum fluctuation set to 5%. A portion of the transaction fee used in each block is set to be automatically burned. Various parameters of the dynamic gas fee model can be changed via the governance function.

The transaction fees for Kaia Blockchain are currently determined by applying a dynamic gas fee model. However, a new gas fee model or transaction fee policy may be required according to the environmental changes. If necessary, changes to the gas fee model or transaction fee policy of Kaia Blockchain will be made through the governance process.

Block Reward Distribution

The block reward for each block is determined by the sum of the KAIA issued at the time of block creation and the transaction fee. This is distributed as follows. However, the specific ratio and category of the block reward distribution may be changed by governance.

- Validators and Community: 50%

- Of the 50%, 20% is block proposer rewards

- Of the 50%, 80% is staking rewards

- KEF (Kaia Ecosystem Fund): 25%

- KIF (Kaia Infrastructure Fund): 25%

Burning

The method for maintaining or enhancing the KAIA value is an essential element of any incentive structure based on KAIA. In Kaia Blockchain’s ecosystem growth stage, the additional issuance of the KAIA motivates the ecosystem members to participate. However, a method to control the circulation volume is necessary for it to operate as a long-term sustainable incentive. Kaia Blockchain 3-Layer Burn Model prevents excessive inflation. The 3-Layer Burn Model is an extensive concept that includes not only the inherent burning function of Kaia Blockchain but also the burning concept that can occur through relationships with ecosystem projects. This extensive burn model will effectively regulate circulation volume and provide stable value incentives to the network participants when the Kaia Blockchain ecosystem reaches maturity. The description of each Layer is as follows.

- Transaction-Based Burning

This is the default burning method provided by Kaia Blockchain. Users generate transactions to use the blockchain and a portion of the transaction fee is automatically burned. Since transaction-based burning can be interpreted as reduced profits of the node operators, the burning extent is adjusted through agreement and consensus among key network participants through on-chain governance.

- MEV(Maximal Extractable Value) Burning

A validator may receive additional profits (e.g. maximal extractable value) by taking advantage of the fact that they can determine the transaction order during the block proposal process. This structure can escalate into issues of censorship or unfairness. As a result, Kaia Blockchain seeks to share the authority of the validator among all users through the implementation of technologies such as on-chain auctions. Part of the profit generated in this process will be burned due to it being generated through a special structural qualification called a validator.

- Business-Based Burning

Business-based burning is not an inherent function of Kaia Blockchain. Rather it is implemented through the ecosystem services and business relationships. Ecosystem services can receive support from protocols such as Kaia Ecosystem Fund to initially accelerate growth. Additionally, the value of KAIA or the activation of Kaia Blockchain affects the activation of services considering services utilize blockchain functions. Kaia Blockchain encourages the ecosystem services to install the concept of burning KAIA within the service to ensure that the service and blockchain maintain the value of KAIA under the same goal.

Validator Incentives

Validators are operators in Kaia Blockchain who are responsible for block creation and verification based on the consensus algorithm. Validators are required to stake at least 5 million KAIA on the nodes they operate. In addition, validators participate in the on-chain vote of Kaia Blockchain and have the qualifications of GC (Governance Council), which makes key decisions in the ecosystem. In the future, the concepts of validator participating in block creation and GC participating in decision-making will be separated, so that anyone meeting certain conditions could participate in block creation and verification even if they are not a GC. Research and development of building this permissionless network is in progress.

Two types of incentives are provided to encourage validators to operate nodes: block proposer rewards and staking rewards.

-

Block proposer rewards are for the act of participating in block creation and verification. At the time of block creation, an identical amount of KAIA will be distributed to all validators activated on the network. 10% (20% of the 50% Validator and Community Rewards) of the total annual inflation issued will be allocated as block proposer rewards. However, the size of the reward in a specific block may vary depending on the number of validators active at a specific time.

-

Staking rewards are for staking KAIAs and contributing to the network stability and economic stability of Kaia Blockchain. The size of the reward is determined in proportion to the amount staked by a specific validator to the total amount of KAIA staked by all validators. However, the 5 million KAIA staked by each validator as an obligation is not reflected in determining the staking reward size. 40% of the total inflation will be allocated as staking rewards. The size of the rewards in a specific block may vary depending on the number of the total KAIA staked by the validators active at a specific time.

Kaia Blockchain Validator Reward Mechanism

Every block will have a committee made up of randomly selected validators. Each committee will have one member to act as a proposer, and all other committee members will act as verifiers. When a block is successfully created and added to Kaia Blockchain, the proposer of that block will be rewarded with 10% (20% of the 50% Validator and Community Rewards) of the total annual inflation issued and additional transaction fees. With regard to transaction fees, if the total amount of transaction fees incurred in one block is less than the block reward, the fees will be burned. If the transaction fee exceeds the block reward, half of the exceeded amount will be burned and the remaining half will be rewarded to the block proposer. Staking rewards equivalent to 40% (80% of the 50% Validator and Community Rewards) of the total annual inflation issued are shared among the validators in proportion to their staking amount. As long as the Kaia Blockchain validators meet the minimum 5 million KAIA staking requirement, they are free to stake or unstake their KAIA. Staking information changed within the staking update cycle will have a final update in the last block of each cycle. Another cycle is required for the updated information to be reflected in the block incentive. For example, staking information added at block 80,000 will be last updated at block 86,400 and reflected in incentives starting at block 172,800. A one-week delay is required to withdraw the staked KAIA to prevent any immediate withdrawals by malicious members.

Kaia Blockchain Fund

Background

The financial resources of the Kaia Blockchain ecosystem are reorganized and operated into the Kaia Ecosystem Fund (KEF) and Kaia Infrastructure Fund (KIF). Both KEF and KIF will be used to establish stable integrated governance and an active ecosystem and will be transparently executed according to the agreed-upon ratio. The usage plan of the ecosystem resources will be shared with the community in advance. Especially for KEF, individual expenditures will be executed with GC approval. This will allow all ecosystem participants to be proactively aware of the impact of the ecosystem resource execution.

Kaia Ecosystem Fund

Definition

Kaia Ecosystem Fund (KEF) is a financial resource used to ensure the sustainability of Kaia Blockchain mainnet by strengthening the basic ecosystem infrastructure, supporting developers, and returning profits through indirect investments back to the ecosystem. For this purpose, 25% of the total KAIA issued when creating a block will be distributed to KEF. KEF can only execute funds for agreed purposes with prior approval from the governance with all execution details being transparently disclosed.

Usage

The uses of KEF are categorized as follows:

-

Service Contribution Reward (SCR): This reward is given to service developers or users operating on the integrated ecosystem, as compensation for directly or indirectly contributing to the enhancement of the ecosystem's value.

-

Developer Community Development: This includes support for various hackathons, operation of development education programs, collaborative research with academia, and collaborations with various DAOs.

-

Ecosystem Services and Infrastructure Development: This involves the development of services with clear utilities, support for marketing, and securing essential infrastructure for the ecosystem.

-

KEF Indirect Investment: This involves medium to long-term investments carried out indirectly through delegation to professional crypto Venture Capitals. A portion of the profits generated from the recovery of investment amounts is either burned or returned to the Kaia Blockchain ecosystem.

-

Governance Committee Budget: This budget is allocated for the operation of committees in specific sectors such as Gaming, DeFi, and Community. The committees aim to grow the Kaia Blockchain ecosystem in their respective sectors through expertise in investing, marketing, grants, and providing liquidity.

-

Other ecosystem and community-building activities

Execution Method

KEF operates under a system where the Governance Council (GC) reviews and approves the use of its funds. The budget executed through the foundation is managed through the following process:

-

Each quarter, necessary budgets by category of expenditure are reported to and approved by the GC.

-

Within the approved budget limits, specific expenditures are also approved individually by the GC.

-

Details of the expenditures are transparently disclosed after their use.

Even if not through the foundation, new proposals for the use of KEF can be made via the GC, and these specific proposals will also require individual approval by the GC. Plans are in place to develop and enhance a structure that allows more ecosystem participants to efficiently propose and participate in the use of KEF. Additionally, for some categories requiring more specialized and rapid decision-making, separate governance committees may operate.

Kaia Infrastructure Fund

Definition

Kaia Infrastructure Fund (KIF) is a financial resource used for purposes such as R&D, ecosystem acceleration, and foundation operation. For this purpose, 25% of the total KAIA issued when creating a block will be distributed to KIF.

KIF is executed by the foundation through an internal control system after a prior announcement of the budget plan for each detailed category with all execution details being transparently disclosed.

Usage

The uses of KIF are categorized as follows:

-

Mainnet and Essential Infrastructure R&D: Advance research on the latest technologies related to mainnet and infrastructure, foundation-led service development, infrastructure establishment, etc.

-

Ecosystem Acceleration: Token swap, financial support for small-scale Kaia Blockchain ecosystem partners, attraction of new GC, provision of market liquidity, etc.

-

Operation of Kaia Foundation: Operating costs (various service costs such as development, accounting, legal affairs, as well as IT infrastructure operation costs, marketing costs, labor costs, etc.), financial management, fundraising, etc.

Execution Method

The foundation directly establishes a budget plan and executes the funds accordingly for KIF. To ensure transparent execution, the foundation discloses the budget plans and execution details in advance and afterward.

-

Establishment of the budget and fund execution plan by the foundation

-

Disclosure of the budget plans by detailed category

-

Disclosure of the execution details after executing the funds through an internal control system by the foundation

KAIA Issuance/Distribution Plan

As the Klaytn and Finschia ecosystems merge, KLAY and FNSA, which were the base coins of each ecosystem, will also be consolidated into KAIA. Consequently, the issuance and circulation plan for KAIA will inherit the plans from KLAY and FNSA. This section will examine the historical issuance and circulation data of KLAY and FNSA and, based on this, will outline the plan for the issuance and circulation of KAIA.

KLAY Issuance/Distribution Status

KLAY Issuance and Burning Volume

On June 24, 2019, a total of 10 billion KLAY were issued on the genesis block at the launch of the mainnet of the Klaytn Blockchain. After the launch of the mainnet, a 3% annual inflation rate was applied based on the genesis issuance volume, newly issuing 9.6 KLAY in each block starting from block 1. Based on the decision of [KGP-3] in October 2022, 6.4 KLAY have been issued for each block starting from November 13, 2022 (#106444801). As for the KLAY burn volume, a portion of the genesis reserve was burned based on [KGP-6] of April 16, 2023, and a portion of circulating supply was burned based on the transaction fee burning and buyback burning. As a result, the estimated total supply is 5,971M KLAY at the time of integration, as of June 27, 2024.

KLAY Private Sale

KLAY did not conduct an ICO after issuance and only conducted private sales for institutional investors.

The private sales were divided into ER (Early Round) and PR (Private Round) from 2018 to 2019. The quantity sold through the private sales was 1,624,251,988 KLAY. The funds were used as operating funds for the mainnet development and operation, and ecosystem expansion. Approximately 1.62 billion KLAY sold through private sales were all unlocked in March 2021 after a step-by-step vesting period, and are already included in the circulating supply.

KLAY Circulating Supply

The circulating supply of a cryptocurrency is the total currently tradable supply of the total issued volume of a specific existing cryptocurrency. In other words, it is the amount that is actually traded and distributed in the market. As of June 27, 2024, the expected integration date, the estimated total supply of Klaytn Blockchain will be 5,971M KLAY, excluding the not yet distributed Klaytn Community Fund (KCF)4 of 153M KLAY, Klaytn Foundation Fund (KFF)5 of 29M KLAY, and KLAY Value Creation Fund (KVCF)6 of 2,000M KLAY. These numbers are current estimates and may vary slightly due to block generation status, inflation, and governance proposal approvals. Considering that KVCF requires separate approval from the GC, the circulating supply increases when the execution of KCF or KFF is decided and executed. On the other hand, the circulating supply decreases when it is burned due to transaction fees or buybacks. Accordingly, as of June 27, 2024, the total issued supply is 5,971M KLAY while the circulating supply is 3,789M KLAY. There are no plans to use the KVCF until the time of the merger. The KLAY circulating supply will be inherited by the initial circulating supply of KAIA after the chain and token merger.

FNSA Issuance/Distribution Status

FNSA Issuance and Burning Volume

FNSA of Finschia has been automatically issued in each block at an inflation rate of 15% per year on the current total supply according to the Issuance mechanism of the protocol. Initial total supply was 6,734,458 FNSA. The FNSA issued is distributed to the Network Contribution Reward, Service Contribution Reward, and Reserve at a corresponding ratio of 5:3:2 according to the distribution mechanism. No volume of FNSA was burned. As of June 24 2024, the expected integration date, the estimated total number of FNSA issued through inflation is 7.967M FNSA.

FNSA Private Sale

FNSA did not conduct private sales.

FNSA Circulating Supply

The total supply and circulating supply of FNSA are equal. In other words, there is no separate uncirculated volume. Additionally, FNSA will set the inflation to 0% and stop new issuance after prior notice before the integration to ensure smooth integration with KLAY. As of June 24 2024, the expected integration date, the estimated total number of FNSA issued through inflation is 7.967M FNSA. The final confirmed total supply of FNSA will be included in the initial distribution of KAIA and inherited according to the agreed-upon exchange ratio.

KAIA Issuance/Distribution Plan

The KAIA token is created by combining the existing KLAY tokens and FNSA tokens at the time of integration. There may be slight changes in the circulating supply of KLAY and FNSA tokens before the integration through the inflation and burning of block rewards. The circulating supply of the existing KLAY and FNSA at the time of integration will be included in the KAIA circulating supply according to the corresponding exchange rate. Details will be guided through a separate post-announcement by the foundation. The exchange rate for each token to KAIA is as follows:

-

KLAY: KAIA = 1:1

-

FNSA: KAIA = 148.079656:1

The estimated circulating supply at the time of integration and KAIA circulating supply can be explained separately as follows:

Estimated Supply of KLAY and FNSA

- Estimated Circulating Supply7

- KLAY: 3,789M KLAY

- FNSA: 7.967M FNSA

- Estimated Uncirculated Volume

- Klaytn Value Creation Fund (KVCF): 2,000M KLAY

- Klaytn Community Fund (KCF): 153M KLAY

- Klaytn Foundation Fund (KFF): 29M KLAY

Estimated KAIA Issuance Volume

- (+) Conversion of circulating supply (4,968M KAIA)

- Converted KLAY circulating supply: 3,789M * 1 = 3,789M KAIA

- Converted FNSA circulating supply: 7.967M * 148.079656 FNSA = 1,179M KAIA

- (-) Burning of uncirculated volume

- KVCF + KCF + KFF = 2,182M KAIA = Burn 1,382M KAIA out of 2,182M KAIA

- (+) Conversion8 of uncirculated volume remaining after burning into circulating supply

- LINE NEXT Delegation: 330M KAIA

- Kaia Ecosystem Fund: 270M KAIA

- Kaia Infrastructure Fund: 200M KAIA

Since the entire uncirculated amount gets burned at the time of KAIA conversion, the total supply and the circulating supply match. The estimated circulating supply at this time of integration is about 5,768M KAIA.

However, the mentioned numbers are based on the issuance and circulating supply estimation as of May 14, 2024, GST, and the final figures may change depending on the inflation of Klaytn and Finschia.

The circulating supply after the token merge may increase according to the measures mentioned in Kaia Blockchain Fund or decrease due to burning. However, as specified in the relevant section, any additional supply must be announced in advance or approved by governance.

Treasury Rebalance Plan

With the launch of the Kaia Blockchain, the new tokenomics mentioned in the Tokenomics section will be applied. This involves a massive scale of tokens, including the conversion of existing FNSA and KLAY circulations to KAIA, new fund allocations, and burned tokens. A treasury rebalance event will occur only once at the launch, which is a critical process that must be systematic, transparent, and auditable. To ensure this, all procedures will be meticulously recorded in smart contracts. Moreover, given the large volume of tokens involved, it is vital to apply various technologies to prevent errors (such as fat finger errors) and minimize security risks. The application of the new tokenomics is structured to proceed safely only after several conditions are met. Ultimately, the new tokenomic state is achieved through the consensus of validators, relying on the highest level of security available on the blockchain.

The overall process is as follows. A contract named TreasuryRebalance is deployed, followed by the uploading of a rebalance configuration into this contract. All stakeholders whose balance will be altered must approve of the configuration. Once all stakeholders have approved, block validators check the validity of the contract at the hardfork block at which the rebalance event takes place. Provided all conditions are met, block validators execute the rebalance event and reach a consensus. After the event was successful, an execution receipt which block providers output will be uploaded to the contract so that anyone can view the rebalance result.

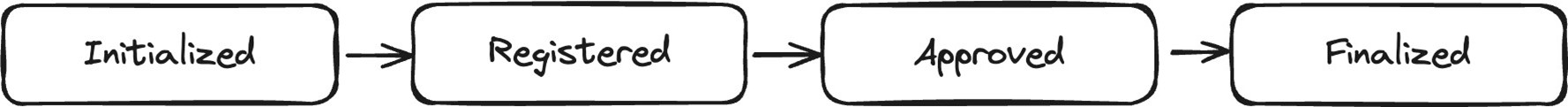

TreasuryRebalance contract is implemented as a finite state machine and has the following states:

-

Initialized: right after the deployment. In this state, a list of addresses whose balance will be zeroed, namely “Zeroed”, and addresses whose balance will be allocated, namely “Allocated”, can be registered.

-

Registered: after all Zeroed and Allocated has been registered. In this state, there cannot be further registration. All owners of Zeroed must send a consent transaction, which indicates that they approve that their balance will be burnt.

-

Approved: after all consents have been collected, the contract can enter Approved state. Any change in this contract is prohibited until the hardfork block passes.

-

Finalized: After the hardfork block, the rebalance result, namely “memo”, is recorded and the contract is finalized. The contract is rendered immutable.

The state transition is only possible in the following order. However, there can be a “reset” where all data is deleted and the state goes back to initialized.

All block validators validate the contract state at the hardfork block. The rebalance event takes place only in the Approved state where no further change can happen. Since this event depends on the consensus of all validators, it is ensured that all validators reach the same world state after this event.

All block validators produce the result of the rebalance event called memo in their validator log. The memo is uploaded to the TreasuryRebalance contract during Finalize. memory is a JSON-formatted string which contains information such as the balance of Zeroed before the rebalance, the balance of Allocated after the rebalance, and the burnt amount. The admin of treasury rebalance validates the consistency of the memo and uploads it to TreasuryRebalance contract. After finalization, the contract becomes immutable forever.

Governance

Governance Core Components

Kaia Governance operates based on three main components: Kaia Community, Kaia Council, and Kaia Foundation. Kaia Community encompasses all KAIA holders, who have the right to express their opinions on Kaia Mainnet operations via the governance forum and social channel. Kaia Council represents the community and directly participates in the governance decisions of the project based on the coins it holds and voting rights delegated from the community. Lastly, Kaia Foundation utilizes its expertise in blockchain and Web3 technology to provide evidence, based on professional knowledge and data that could assist Kaia Council in making decisions and implementing the decisions made through governance. Kaia Governance ensures effective decision-making and execution with this systematic structure and pursues transparent and fair community operation.

Governance System

Kaia Governance respects the diversity of the governance system and seeks to create a diverse governance ecosystem through the coexistence, cooperation, and competition of multiple systems. It encompasses various forms of governance found in the real world ranging from representative democracy, where each individual grants voting rights to decision-makers to representatives, the DAO system, where all members participate in the decision-making process of the organization, and capitalism, where shareholders influence company decisions through representatives designated by shareholders. Kaia Governance seeks to lay the foundation for a transparent and fair blockchain ecosystem through this comprehensive approach. Its vision is to build a stronger and more flexible system by combining the strengths of multiple governance models.

Community-Centered Governance

At Kaia, organizations based on various governance systems will participate in governance, express their opinions, and thereby prove the excellence of their systems. More holders and assets will be concentrated in systems that have proven their greater contribution to the sustainable development of the Kaia ecosystem, resulting in more decision-making authority being concentrated in members with successful systems. Also, the council members will replicate successful governance, expanding the system.

As time passes, optimized governance systems for new trends will emerge. Kaia Governance will continue to develop focusing on the optimized governance system in line with these changes, which will contribute to an increased efficiency of the entire ecosystem. In the process, Kaia will present an example of a governance system with both diversity and flexibility and will lead the innovation in governance in the blockchain ecosystem.

Kaia builds the Kaia Governance system based on the belief that Web3 innovation has its roots in the participation of various communities. In line with this hypothesis, greater importance is given to community input in the decision-making process. As a result, it ensures that decision-making power is fairly distributed among different council members. Through this approach, Kaia Governance aims to foster sustainable development and innovation in Web3 by prioritizing the voices of the community and creating a more inclusive and diverse decision-making environment.

Governance Direction

Kaia Governance adopts a strategy of adjusting the pace of the governance process, considering changes in the cryptocurrency market and the development stage of the Kaia ecosystem. The discussion and processing speed of the agenda are determined through a consensus between the foundation, council, and community, which reflects the rapidly changing cryptocurrency market situation and the ongoing growth process of Project Kaia. Currently, in 2024, the ecosystem of Project Kaia is still in the development stage despite the rapid progress over the past five years, and Kaia takes a governance approach with growth as its priority. By establishing a structure where the agendas can be discussed and decided quickly, the project plans to proactively respond to the changing market environments and accelerate the growth of the ecosystem.

Technology

Overview

Kaia Blockchain has three primary technical objectives.

First, performance is paramount. The blockchain emphasizes rapid finality, ensuring that users receive immediate responses. It also aims to process a high volume of user requests quickly, enabling blockchain applications (dApps) on Kaia Blockchain to offer a user experience comparable to conventional mobile apps.

Second, transparency is crucial. Decision-making at the layer 1 protocol has widespread implications across the ecosystem. Therefore, decisions should be made transparently through on-chain governance. Furthermore, Kaia Blockchain intends to publicly disclose all elements related to the operation of the blockchain network, ensuring that it is fully verifiable by anyone.

Third, sustainability is essential. Operating a blockchain over the long term presents various challenges, such as the continuous increase in block data and the economics necessary to sustain network operations. Kaia Blockchain is designed to reduce operational costs and increase profitability, ensuring its long-term viability.

The forthcoming content will cover two main topics. The first is the genesis of the Kaia Blockchain, describing the technologies applied, including consensus mechanisms, smart contracts, and on-chain governance, which collectively reflect the extensive technical considerations made to achieve its goals. The second topic is the evolution of the Kaia Blockchain. It will introduce a variety of new technologies that are planned for the near future, including maintaining high performance while allowing anyone to operate a validator node in a permissionless manner, enhancing transparency in block transaction ordering to mitigate the negative effects of Maximal Extractable Value (MEV), and block archiving techniques for swift verification of historical blocks. These innovations will set the Kaia Blockchain apart, enhancing its uniqueness and attractiveness.

Birth of Kaia Blockchain

To achieve the aforementioned technical goal, Kaia Blockchain is launched with various technical features. Specifically, the performance goal is facilitated by consensus and network topology, and the transparency and the sustainability is facilitated by smart contracts and on-chain governance. The initial performance of Kaia Blockchain is as follows:

-

Process 4,000 transactions/sec (TPS)

-

Instant transaction finality

-

Creation time of 1 block/second

Consensus and Networking

Blockchains use a “distributed ledger,” which consists of a connected network between individuals with several network participants to record and manage the transaction information. Each blockchain adopts a consensus algorithm that is most suitable for it, with the aim of efficient and smooth consensus on transaction validation and block generation among network participants. These consensus algorithms help the system to reach a consensus on the correct state, even if there is a system failure or malicious attack on the network. They play an important role in ensuring the integrity and stability of the blockchain.

IBFT (Istanbul Byzantine Fault Tolerance)

Kaia aims to become an enterprise-support and service-oriented platform. Therefore, the finality problem must be solved, with the network allowing many nodes to participate in the network. For this purpose, Kaia uses an optimized version of Istanbul BFT, which implements PBFT with modifications to suit the characteristics of blockchain networks.

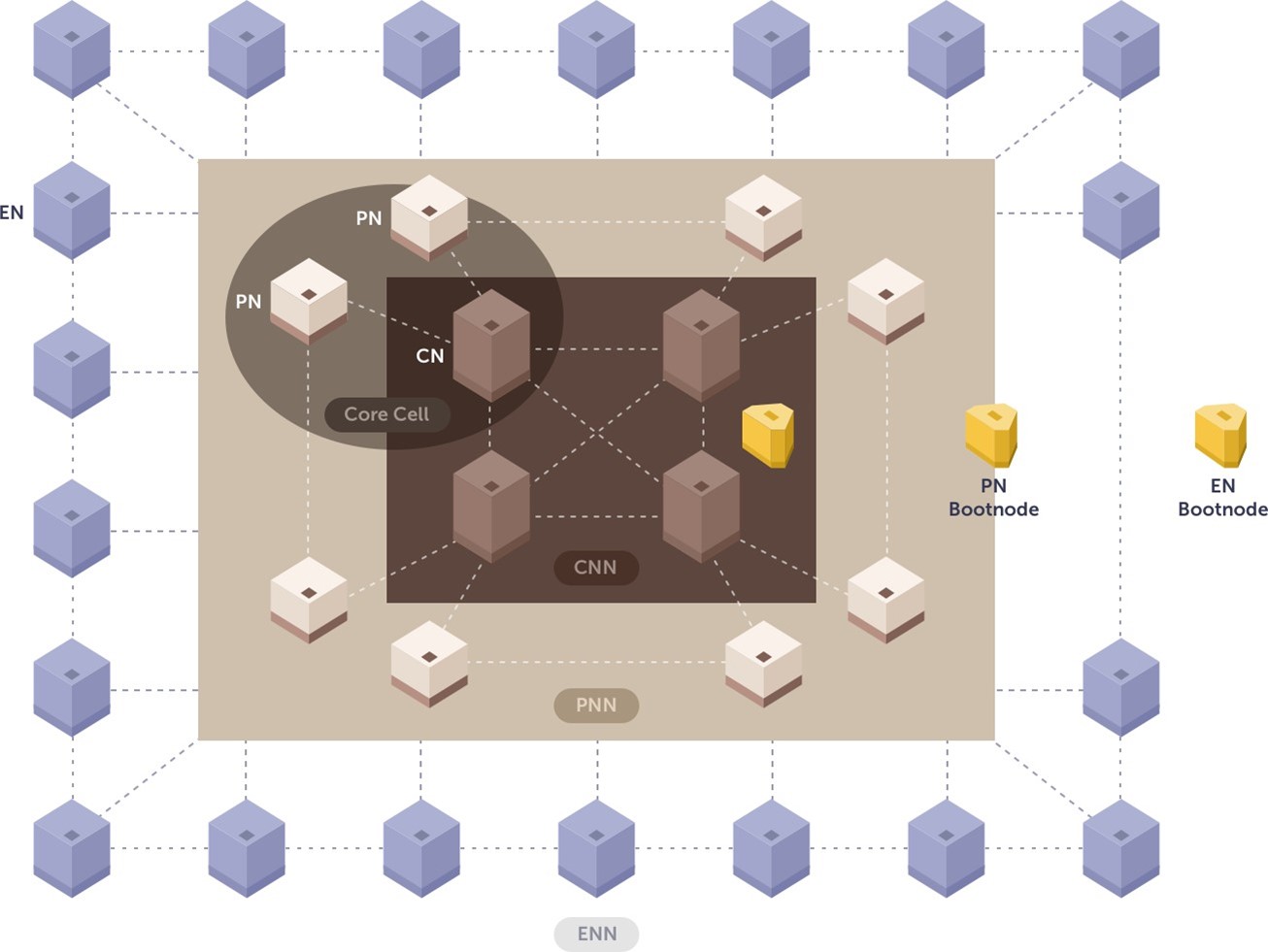

Kaia Blockchain has three types of nodes: Consensus Node(CN), Proxy Nodes(PN), and Endpoint Nodes (EN). CN is managed by a validator and is responsible for block creation. These blocks are verified by all the nodes within the network.

Kaia Blockchain has adopted and enhanced Istanbul BFT to achieve rapid finality. Since validation and consensus occur with each block, there are no forks, and the finality of the blocks where consensus is reached is immediately guaranteed. Block proposers are selected in an unpredictable manner using a Verifiable Random Function (VRF), thereby offering high resistance to centralized Denial of Service (DoS) attacks. CN must deposit a certain amount of tokens, maintaining reasonable networking costs while enabling easy operation by any EN, thus enhancing the scalability of the blockchain network usage.

Multi-channel Broadcast

Network latency is greatly affected by network congestion. Assuming the throughput of the network is constant, network latency increases proportionally to the increase in the number of transactions. General users of mobile apps or web services do not tolerate response times longer than a few seconds, and there is no reason to assume that blockchain services will have greater user patience.

Kaia Blockchain adopts a multi-channel approach to deal with network congestion. By allocating separate propagation channels to transactions and blocks, the Kaia network can propagate newly created blocks in a timely manner even when the network faces severe congestion due to a large number of transactions. In turn, Kaia guarantees the dApps on the network to continue responding to end-user requests despite intermittent network traffic surges.

Consensus Process

The consensus process consists of the following three stages:

-

Election: The Committee is composed of Consensus Nodes (CNs) that participate in achieving consensus. This is a similar task to the leader election in a general distributed system. The proposer is randomly selected through VRF since knowing them in advance can make them vulnerable to targeted DoS (denial of service).

-

Block Generation: Elected proposers create a block and make a proposal to the committee. The block proposal made through the P2P network is sent to the committee.

-

Block Verification: The committee verifies and signs the block proposed by the proposer. A block is complete when more than a quorum of signatures is collected.

Account Model and Smart Contract

Kaia Blockchain offers scalability in service development through its expanded account model and smart contract capabilities. Smart contracts on the blockchain enhance the efficiency of transactions and contracts between individuals through contract automation, and the use of smart contracts has had a significant impact on the blockchain and dApp ecosystem. Contract conditions can be coded into smart contracts and automatically executed, solving the trusted intermediary issue. Smart contracts have allowed the blockchain ecosystem to create new business models and economic systems by reducing the cost and time required to complete transactions. Kaia Blockchain supports a distributed virtual machine for executing smart contracts, which is designed to be fast and efficient, providing the best and swiftest development environment for dApp developers and projects.

Account Model

The Kaia Blockchain supports an expanded form of the Account Model. Inside the implementation of an EOA (Externally Owned Account) account, it is possible to store an Account Key, which is an expanded form of the EOA's Public Key. This information allows users to replace the Private Key associated with that account. Additionally, users can register multiple Private Keys for use in Multi-Signature setups or to separate roles among different Private Key users. The roles provided include the authority to create transactions, update registered keys in the Account, and permissions solely for fee delegation purposes.

Kaia Virtual Machine (KVM)

The current version of Kaia Virtual Machine (KVM) is a derivative of the Ethereum Virtual Machine (EVM). It supports all Opcodes of the Ethereum Virtual Machine equally while providing additional precompiled contracts unique to the Kaia Virtual Machine. To prevent the additional precompiled contracts of Kaia from colliding with the precompiled contracts of the Ethereum Virtual Machine, the precompiled contract addresses of Kaia are given in a decreasing order starting from 0x03ff.

Kaia Virtual Machine provides several methods to write and run Smart Contracts on the Kaia network. Kaia supports Solidity and maintains interoperability with Ethereum development toolkits such as Remix, Hardhat, Truffle, and Foundry. A smart contract written with Solidity can be compiled using the existing Solidity compiler and can be run on Kaia without additional work. Solidity is the de facto standard contract programming language on Ethereum and is supported by an active community. Therefore, Kaia Blockchain supports the Solidity language to provide the most familiar development environment for Ethereum dApp developers allowing them to easily migrate their work.

System contracts

Kaia Blockchain manages a part of protocol as smart contracts, which are called system contracts. Block validators directly or indirectly interact with system contracts. System contracts facilitate transparent and easy-to-access protocol operation. There is a specification that defines a Registry contract which will contain new system contracts. It can be viewed by a REST API and thus users can continuously check and monitor system contracts.

Since system contracts can directly impact the blockchain protocol, they need to be managed in a highly secure manner. They are internally classified as the highest level of security, and thus they are managed as a multi-sig by default. Storing of keys and signing of transactions are performed in an isolated device which is never connected to online. In addition, there are internal manuals and tools for systematic management of system contracts.

These are essential system contracts:

-

AddressBook: a contract which manages a list of validators.

-

GovParam: a contract for on-chain governance on network parameters .

-

SimpleBlsRegistry: a BLS key storage for validators.

On-Chain Governance

On-chain governance is an on-chain decision-making system among stakeholders. On-chain governance is implemented in a structure including smart contracts and has several advantages over off-chain governance. The entire process of governance is transparently recorded, and anyone can check the progress of governance on-chain (transparency). Since the governance process proceeds solely according to the contract logic, the voting and results cannot be tampered with maliciously (integrity). Therefore, the intentions of the participants can be reflected without any distortion in the governance process. Also, it is impossible to deny a vote because no one except the voter can vote (non-repudiation). As a result, the voters become accountable for their voting behaviors. An environment where the voting results can be enforced compulsorily or automatically can be created (enforceability). Without enforceability, the implementer may ignore the voting results, which will eventually reduce the credibility of governance.

Kaia Blockchain implements an on-chain governance system satisfying the above properties. The on-chain governance of Kaia Blockchain is designed to be fair and to ensure diverse opinions are shared. Voting entities can vote on all agenda items. Voting rights are calculated in proportion to the amount of staking. However, there is a cap on voting rights to prevent minority opinions from being ignored. Users can delegate their staking amount to other voters.

The voting process is transparent and open. Types of agendas include text agendas, parameter change agendas, and fund expense agendas. For some agendas, such as parameter change agendas, a transaction can be attached to the agenda. In this case, once the agenda is passed, the transaction will be automatically executed. This allows the mandatory performance of governance by automatically reflecting the changes in network parameters as well as executing funds through governance.

Other than this, various detailed policy decisions, such as restrictions on voting rights, voting periods, and voter participation, are needed for a comprehensive and fair decision-making system. A highly reliable network will be built by establishing a governance system that harmoniously reflects the needs and expectations of various stakeholders.

Governance Process

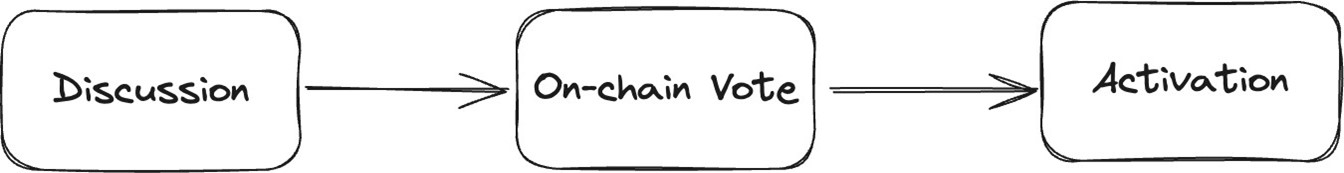

The overall governance process of Kaia is as follows:

-

Discussion: Improve the agenda through free discussion among all participants off-chain.

-

On-Chain Agenda Voting: Register the agenda on-chain and proceed with voting.

-

Reflect Results (Activation): Implement when agenda items are approved.

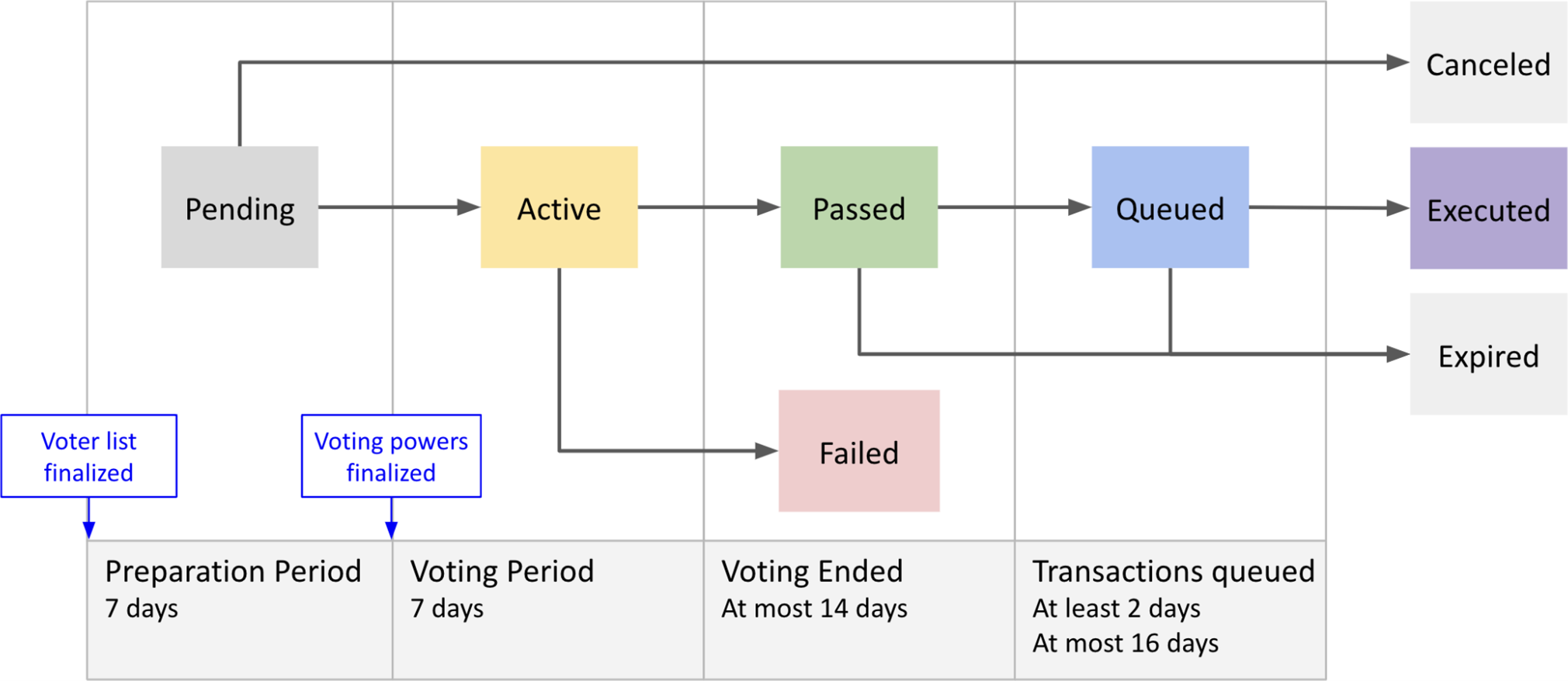

Agendas registered on-chain go through several states until the voting is complete.

-

Pending: Status after the agenda is registered and until voting takes place. As the agenda is registered, the list of voters is determined.

-

Active: Voting is in progress. The voting power of the voters gets fixed when voting begins.

-

Passed: Agenda passed with the approval of a quorum.

-

Failed: Agenda rejected because it did not receive a quorum of approval votes.

-

Queued: Waiting period after the passing of the agenda and before the execution.

-

Executed: Agenda fully executed.

Enforceability

Kaia Blockchain is configurable via several network parameters, with which they can be altered by on-chain governance. An example of network parameters is “upperboundbasefee”, which defines the maximum value to which the dynamic gas fee can go up. There exists a system contract named GovParam, which enables the enforceability of the governance proposal. This contract is a key-value storage with an activation number for each key. A value of network parameter can be updated by submitting a tuple of (param as a key, new value, activation block number), which will be read by validators and be activated starting from the activation block.

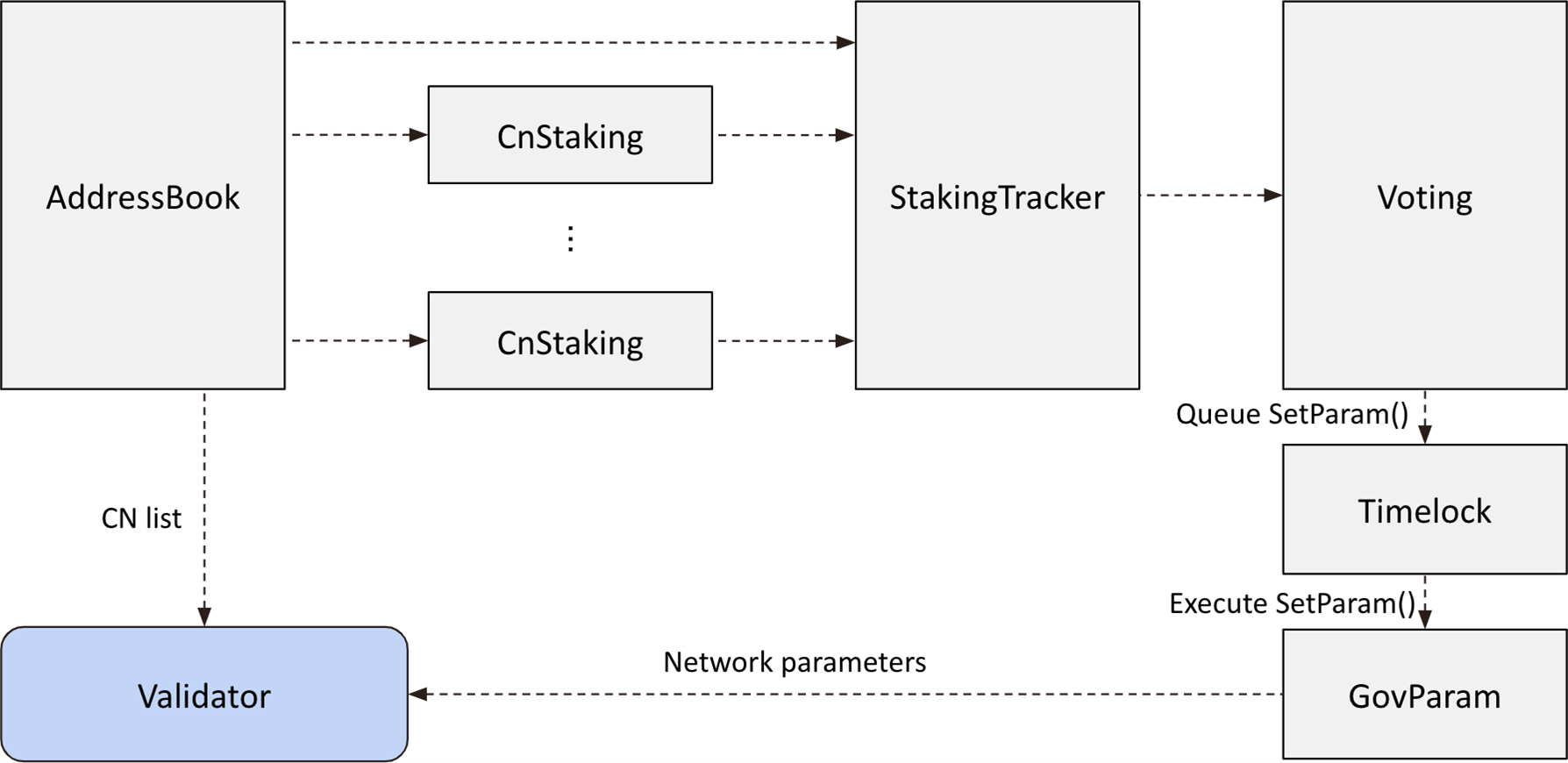

The above figure shows how network parameters are updated via on-chain governance. A governance proposal can contain a transaction, which will be executed once the proposal passes. When proposing, the proposer attaches a transaction which invokes GovParam. When the proposal passes, the secretary sends a transaction to execute the proposal, which will internally invoke the transaction contained in the proposal. Validators check GovParam every block and apply the new network parameter value at the activation block. In this way, the network parameters can be enforced in a decentralized manner.

Kaia Evolution

The Kaia Blockchain is committed to continuously adopting new technologies to achieve the three technical objectives introduced earlier. Some of these technologies are expected to be developed and implemented in the near future. Specifically, new technologies that Kaia blockchain will adopt can improve the aforementioned three goals; high performance permissionless allows anyone to become a node validator, mitigating the negative effect of MEV with transparent tx ordering, archiving old blocks in a verifiable manner, and public governance delegation can facilitate high performance, transparency, and sustainability.

High-Performance Permissionless

BFT-type consensus algorithms generally have restrictions in the process of participating as a validator. This is due to the tendency of the performance of the entire network to deteriorate caused by abnormal nodes when validators participate freely. As an integrated chain, Kaia pursues a completely permissionless network and will develop into a network where anyone can participate as a block creation node while maintaining high performance. After introducing the Permissionless Network, nodes meeting certain conditions will be given the role of block creation nodes. Specifically, an automated qualification verification process will be introduced to check whether the block creation node is qualified to maintain stability. In terms of consensus participating in the creation and verification of blocks, there are “candidates” and validators. In terms of governance, there are Governance Council Members. One can register as a candidate and meet specific conditions to become a validator. Validators can receive rewards by participating in the block creation consensus process. Permissionless Network is implemented through the following factors:

-

Unpredictable Proposer Selection Algorithm: An algorithm that strengthens resistance to DoS attacks by changing the block proposer selection method difficult to predict.

-

VRank (Validator Reputation Evaluation Framework): A framework that evaluates the reputation of a validator.

-

Autonomous Validator Slashing System: A system that penalizes erroneous or malicious actions of validators.

-

System Transaction and Consensus Msg: A reflection of the latest consensus information in the contract for each block through a “system transaction” automatically generated by the block proposer.

Maximal Extraction Value

MEV (Maximal Extractable Value) is the potential benefit that can be gained by strategically ordering or changing the transaction order in a block. MEV involves unfair practices, such as front-running, to gain profits at the expense of other users. Kaia Network aims to build a system that ensures a fair and transparent transaction order to mitigate the negative effects of MEV. Also, a method to redistribute or burn MEV extraction profits into the network ecosystem will be provided to support the sustainable development of the network. Lastly, a system to monitor and share transactions in real time will be implemented to prevent any unfair practices that may be carried out by validators, increasing the reliability of the network. This will not only increase the transparency and fairness of the Kaia network but will also greatly contribute to the sustainable development of the ecosystem.

Block Data Archiving

Blockchain continuously has an increase in the blocks (data) stored over time due to transaction history and execution of smart contracts. The capacity of Kaia Blockchain is growing even faster due to its short block time and high transaction throughput (TPS). As a result, the cost of new validators participating in the network and verifying the blocks by synchronizing them is also increasing. The volume of data accumulated over the years is not small, and it takes a lot of resources to verify it. High verification costs work as a barrier for new validators to enter, which can reduce the reliability of the chain. To solve this issue, Kaia Blockchain will study how to reduce the verification cost of past blocks. The following methods will be considered and introduced as they compress or archive old blocks in a verifiable manner so that only the archived data can be quickly verified without each block having to be verified.

-

Verifiable block data compression: Compresses blocks in a verifiable manner.

-

Block data pruning at a certain block cycle or data unit

-

Convert the blocks pruned in on-chain into a verifiable certificate and record in on-chain. This certificate is compressed and recorded as a Commitment using cryptography (such as KZG) or Proof using the recursion method of ZKP.

-

Support a verification system that can verify certificates in on-chain

-

Verification system efficiently and constantly verifies certificates.

-

At the time of compression, the certificate is verified and recorded in the block when the next block is created.

-

Anyone can verify the corresponding certificate through a verification system.

-

-

-

Lightweight block synchronization: When participating as a new node or verifier, synchronize and verify the compressed certificates and subsequent blocks rather than synchronize the entire block data.

-

Support DA Layer: Some users and dApps require a checkup on historical data. A DA Layer is provided to provide trusted data without faults.

By dramatically reducing the verification cost by the above methods, new validators will be able to onboard quickly.

Public Delegation

Kaia Blockchain provides a function where validator operators can be delegated. To provide this function as a default, Kaia Blockchain will additionally develop and provide a contract providing a public delegation function in conjunction with staking contracts for validators. This will allow users to participate in governance in the future by expanding the voting power of voters by delegating tokens to other voters expressing opinions on their behalf. This structure is similar to representative democracy, a form of politics in which the people elect members of the National Assembly, and the members of the National Assembly vote when the National Assembly passes an agenda. The users, furthermore, can delegate or revoke their delegation whenever they wish in Kaia Blockchain. This will allow general holders to reflect their opinions in governance and a governance system respecting diverse opinions will be established.

Roadmap

Kaia Blockchain is an integrated mainnet platform that started with the integration of the Finschia Foundation and the Klaytn Foundation. Its core goal is to provide an infrastructure for the adoption of Web3. To achieve this goal, Kaia Blockchain seeks to facilitate the development of blockchain-based projects through builder-centric support. Through this, new potentials of Web3 technology will be explored. Kaia Blockchain provides developers with essential toolkits, SDKs, and IDEs to help them easily implement innovative and competitive solutions at all stages of project development.

In addition, strategies such as messenger integration through cooperation with Kakao and LINE will help Web2 users easily transfer to Web3. This approach will accelerate the adoption of Web3 technology and allow more users to experience the benefits of blockchain technology. Kaia Blockchain will foster the growth of a strong developer community and explore new possibilities in blockchain technology by enabling access to various infrastructure assets and KAIA funds while also supporting decentralized governance and permissionless participation.

The roadmap of the integrated mainnet focuses on supporting developers and driving Web3 adoption at the same time. This will enable Kaia Blockchain to help both developers and general users build successful projects, adopt blockchain technology more broadly, and establish a solid foundation to explore the new possibilities of the Web3 world.

Short-term Initiatives

2024 Q1

- Construction and operation of the Klaytn & Finschia integrated TF

2024 Q2

- Establishment of a new integrated chain brand

- Establishment of a joint marketing system and community integration

- Preparation for ecosystem infrastructure, DApp, and service migration (~Q4)

- Network support for integration and response to existing DApps and services (~Q4)

- Preparation for new integrated tokens issuance and swap service provision

- Establishment of the 1st integrated network (EVM)

2024 Q3

- Issuance of new integrated tokens and provision of swap services

- Strengthening of the node user/community delegation function

- Introduction of a new burning model (~Q4)

2024 Q4

- Reorganization of the integrated foundation and promotion of joint business initiatives

- Establishment of the 2nd integrated network

Long-term Initiatives

Establishment of infrastructure for institutional needs

- Establishment of integrated token, Fiat On/Off Ramp, for major Asian countries

- Establishment of infrastructure for improved accessibility by institutional investors

Strengthening of large-scale DeFi infrastructure

- Establishment of a new De-fi ecosystem for the integrated mainnet

- Expansion of RWA (Real World Asset) linked services

Launching of native stablecoins

- Launching of key stable coins based on the integrated mainnet

- Expansion of native stable coin-based services

Asian community boost-up

- Re-establishment of developer and user communities in each Asian country

- Expansion of governance and ecosystem partners in major countries

Discovery of AI DApp categories

- Establishment of new AI DApp categories and activation of onboarding

- Discovery of generative AI-based content/avatar/game Dapps

Large-scale on-chain tokenization of Web2 assets

- Linking of Web2 digital items, memberships, and ticket markets

- Discovery of large-scale item tokenization and mass adoption cases

Onboarding of Asian SSS game companies

- Interoperable game onboarding based on Brown Friends IP

- Web3 game onboarding based on Japanese SSS-rated game company IP

Cooperation in Global IP projects

- Web3 project onboarding of large global IP companies

- Strengthening of onboarding infrastructure for Web2 companies

Important Notes

Disclaimer of liability

To the maximum extent permitted by the applicable laws, regulations and rules, the Kaia Foundation shall not be liable for any indirect, special, incidental, consequential or other losses of any kind, in tort, contract or otherwise (including but not limited to loss of revenue, income or profits, and loss of use or data), arising out of or in connection with any acceptance of or reliance on this Whitepaper or any part thereof by you.

No representations and warranties

The Kaia Foundation does not make or purport to make, and hereby disclaims, any representation, warranty or undertaking in any form whatsoever to any entity or person, including any representation, warranty or undertaking in relation to the truth, accuracy and completeness of any of the information set out in this Whitepaper.

Nothing contained in this Whitepaper is or may be relied upon as a promise, representation or undertaking as to the future performance or policies of the Kaia Foundation. All information, features, issuances, distributions, and architectures are subject to change at any time, at the sole and absolute discretion of Foundation and/or Kaia Governance depending on the then current roadmap presented in this Whitepaper.

Further, the Kaia Foundation disclaims any responsibility to update any forward-looking statements or publicly announce any revisions to those forward-looking statements to reflect future developments, events or circumstances, even if new information becomes available or other events occur in the future.

Please note that this Whitepaper is also only a work in progress and the information in this Whitepaper is current only as of the date on the cover hereof. The Kaia Foundation reserves the right to update the Whitepaper from time to time.

Staking services

If you choose to participate in the KAIA staking programme, any such service provided to you may be facilitated by the Kaia Foundation acting as a transaction validator on the Kaia and providing its private nodes for staking on your behalf. Any applicable Delegation Rewards will be determined by the protocols of the Kaia and will be credited .

You acknowledge and understand that the Kaia Foundation does not guarantee that you will receive any Delegation Rewards and such staking services do not constitute a fixed deposit product or issuance of securities, which would fall under the regulatory scope of the FSMR.

Withdrawal of staked assets may be delayed as a result of protocol unstaking periods or network conditions, and the Kaia Foundation cannot guarantee the timing and amount of the distribution of the Network Contribution Rewards. The Kaia Mainnet and relevant interfaces used for the delivery of KAIA staking services have inherent risks and the market for KAIA tokens and rewards may be highly volatile due to factors that include but are not limited to adoption, speculation, technology, security, and regulations. You agree and acknowledge that the Kaia Foundation is not responsible or liable for any of these variables or risks.

No advice

No information in this Whitepaper should be considered to be business, legal, financial or tax advice regarding the Kaia Foundation or KAIA. You should consult your own legal, financial, tax or other professional adviser regarding the Kaia Foundation and their businesses and operations, and KAIA. You should be aware that you may be required to bear the financial risk of any purchase of KAIA for an indefinite period of time.

Restrictions on distribution and dissemination

The distribution or dissemination of this Whitepaper or any part thereof may be prohibited or restricted by the laws, regulatory requirements and rules of any jurisdiction. In the case where any restriction applies, you are to inform yourself about, and to observe, any restrictions which are applicable to your possession of this Whitepaper or such part thereof (as the case may be) at your own expense and without liability to the Kaia Foundation. Persons who have been provided access to this Whitepaper or to whom a copy of this Whitepaper has been distributed or disseminated or who otherwise have the Whitepaper in their possession shall not circulate it to any other persons, reproduce or otherwise distribute this Whitepaper or any information contained herein for any purpose whatsoever nor permit or cause the same to occur.

Risks and uncertainties

Prospective purchasers of KAIA should carefully consider and evaluate all risks and uncertainties associated with the Kaia Foundation, and its businesses and operations, and all information set out in this Whitepaper and the T&Cs, prior to any purchase of KAIA.

You should not transact in KAIA if you are not familiar with digital tokens of this nature. Transacting in digital tokens may not be suitable for you if you are not familiar with the technology in which KAIA services will be provided.

You should be aware that the value of KAIA may fluctuate greatly. You should buy KAIA only if you are prepared to accept the risk of losing all the money you put into KAIA.

As previously indicated, participating dApps will receive allocations of KAIA from the Foundation that are to be distributed to dApp users. Subject to dApp’s respective distribution policies, dApps may from time to time, either directly or indirectly, make large distributions of KAIA to users, which could have the effect of increasing the overall supply of KAIA that is traded on relevant trading platforms. It is possible that such distributions could have a negative impact on the market price of KAIA, particularly if a large number of recipients of KAIA engage in sales of KAIA on relevant trading platforms in a short period of time. Please note that a specific way of each dApp’s distributions of KAIA may vary depending upon each dApp’s jurisdiction or country of registration to fully comply with applicable regulations.

KAIA issuance costs

The Kaia Foundation will, in any event, incur no costs in regard to any issuance or distribution of KAIA.

THERE IS NO GUARANTEE THAT THE FUNCTIONALITIES OF KAIA, OR THAT THE KAIA TOKEN ECONOMY INFRASTRUCTURE, WILL BE DELIVERED OR REALISED. IF ANY OF SUCH RISKS AND UNCERTAINTIES DEVELOPS INTO ACTUAL EVENTS, THE BUSINESS, FINANCIAL CONDITION, RESULTS OF OPERATIONS AND PROSPECTS OF THE KAIA FOUNDATION COULD BE MATERIALLY AND ADVERSELY AFFECTED. IN SUCH CASES, YOU MAY LOSE ALL OR PART OF THE VALUE OF KAIA. IN THE EVENT THAT YOU HAVE PURCHASED KAIA, YOUR PURCHASE CANNOT BE REFUNDED OR EXCHANGED.

IF YOU ARE IN ANY DOUBT AS TO THE ACTION YOU SHOULD TAKE, YOU SHOULD CONSULT YOUR LEGAL, FINANCIAL, TAX OR OTHER PROFESSIONAL ADVISOR(S).

Footnotes

-

Kaia is a temporary name for the integrated blockchain project of Klaytn and Finschia, and may be changed in the future. ↩

-

It refers to the temporary foundation name of Project Kaia ↩

-

Specific figures are subject to change upon further review and governance approval. ↩

-

A fund created to revitalize the Klaytn ecosystem and onboard developers, and expenditures are determined after governance approval. ↩

-

A fund created to operate the existing Klaytn Foundation, and expenditures are also determined after governance approval. ↩

-

A reserve created in preparation for the dramatic growth of the Klaytn blockchain. ↩

-

The circulating supply of the Klaytn and Finschia chain may change due to block rewards, etc. until the chain merger. ↩

-

Future circulation will only change due to inflation and new burning models. Incorporation of the circulation amount of the fund does not necessarily mean liquidation, and it will be executed transparently only within the scope of governance approval. ↩